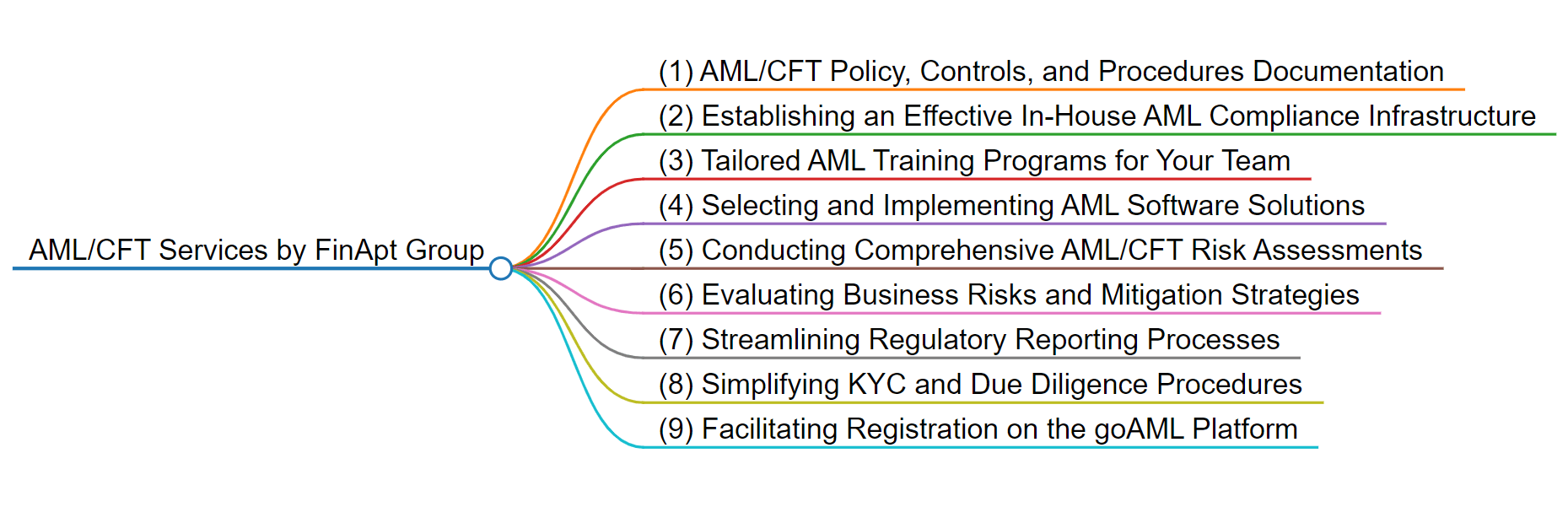

At FinApt Group, we understand the challenges businesses face in navigating complex regulatory landscapes while maintaining operational efficiency and growth. That’s why we offer a comprehensive suite of compliance services designed to address your specific needs and regulatory obligations. With our expertise and tailored solutions, you can rest assured that your business remains compliant and resilient against evolving regulatory requirements.

Take The First Step Towards Success! Submit the Below Form. We Will Get Back to You Soon.

AML/CFT stands for Anti-Money Laundering and Countering the Financing of Terrorism. It’s crucial for businesses to prevent financial crimes, protect their reputation, and comply with regulations.

FinApt offers comprehensive AML/CFT risk assessment, customized compliance solutions, policy development, ongoing monitoring, and training programs.

Non-compliance can lead to penalties, legal repercussions, damage to reputation, and increased risks of financial crimes. Compliance is essential for business integrity.

Ensuring robust Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) policies, controls, and procedures is essential for mitigating financial crime risks. Our team of experts works closely with your organization to develop customized AML/CFT frameworks that align with regulatory standards and industry best practices.

In the UAE, compliance with AML/CFT regulations is mandated by the Central Bank of the UAE and the Financial Action Task Force (FATF) recommendations. This compliance requirement applies to Financial Institutions (FIs) and Designated Non-Financial Businesses and Professions (DNFBPs).

From policy drafting to implementation, we provide end-to-end support to strengthen your defenses against illicit financial activities.

Establishing an effective in-house AML compliance department is crucial for proactively managing compliance risks and safeguarding your business reputation. Our consultants guide you through the process of setting up a robust compliance infrastructure, including defining organizational structures, roles, and responsibilities.

FinApt Group helps you build a compliance team equipped with the necessary skills and expertise to monitor, detect, and prevent financial crime effectively, in line with UAE AML/CFT Compliance requirements.

Knowledge is key to combatting financial crime effectively. That’s why we offer comprehensive AML training programs tailored to your organization’s needs. Our training sessions cover regulatory requirements, red flags, and best practices for detecting and preventing money laundering and terrorism financing activities.

By empowering your staff with the right knowledge and skills, we help enhance compliance awareness and promote a culture of integrity within your organization, aligning with the UAE AML/CFT Compliance framework.

Choosing the right AML software is critical for streamlining compliance processes and enhancing risk management capabilities. Our experienced team assists you in selecting and implementing AML software solutions that align with your business objectives and regulatory requirements.

Whether you need transaction monitoring tools, customer due diligence platforms, or risk assessment software, we help you identify the most suitable solutions to optimize your compliance operations, ensuring adherence to UAE AML/CFT regulations.

Regular risk assessments are essential for identifying and evaluating potential AML/CFT risks within your organization. Our experts conduct thorough risk assessments to assess your exposure to money laundering and terrorism financing risks, providing detailed reports and actionable recommendations.

By staying ahead of emerging risks, we help you strengthen your compliance controls and mitigate the likelihood of regulatory breaches, in accordance with the UAE AML/CFT Compliance framework.

In addition to AML/CFT risk assessments, we offer comprehensive business risk assessments to identify and mitigate risks across various operational areas. Our risk assessment process evaluates internal controls, operational vulnerabilities, and external factors impacting your business.

By understanding and managing risks effectively, you can enhance business resilience and achieve sustainable growth in an ever-changing regulatory environment, including compliance with UAE AML/CFT laws.

Meeting regulatory reporting requirements is essential for maintaining compliance and avoiding penalties. Our team assists you in preparing and filing regulatory reports mandated by relevant authorities. Whether it’s transaction reports, suspicious activity reports, or other regulatory filings, we ensure timely and accurate submission, helping you demonstrate regulatory compliance and build trust with stakeholders, in accordance with UAE AML/CFT regulations.

Know Your Customer (KYC) and Customer Due Diligence (CDD) are vital components of effective AML compliance. Our managed KYC services streamline the customer onboarding process, enabling you to verify customer identities and assess associated risks efficiently. From enhanced due diligence to ongoing monitoring, we help you comply with KYC requirements while minimizing the burden on your internal resources, adhering to UAE AML/CFT legal requirements.

As part of our comprehensive compliance services, we help with registration on the goAML platform. This platform, under FIU, facilitates the submission of suspicious activity/transaction reports (SARs/STRs) and other regulatory filings to the relevant authorities. Our team guides you through the registration process, ensuring seamless integration with your existing compliance framework and regulatory reporting obligations.

Being AML/CFT compliant enhances your reputation and credibility in the eyes of customers, partners, and regulatory authorities.

Compliance with AML/CFT regulations reduces the risk of financial crime, including money laundering and terrorism financing, protecting your business from legal and reputational damage.

AML/CFT compliance opens doors to global markets by demonstrating your commitment to ethical business practices and regulatory compliance.

Effective compliance measures help streamline operations, reduce inefficiencies, and minimize the likelihood of regulatory fines and penalties, resulting in cost savings in the long run.

AML/CFT compliance builds trust with stakeholders, including customers, investors, and regulators, fostering stronger relationships and long-term business success.

At FinApt Group, we are committed to helping businesses navigate the complexities of regulatory compliance with confidence and ease. Our expert team provides tailored solutions that streamline your compliance processes and ensure adherence to regulatory standards. From AML/CFT compliance to regulatory reporting, trust FinApt Group to be your partner in achieving compliance excellence.

FinApt Chartered Accountants

FinApt Corporate Service Providers

FinApt Management Consultancies