Valuation is not a number. It’s a story It’s a story — defended by data.

n today’s deal-driven and reporting-intensive environment, valuation plays a critical role in investor confidence, transaction strategy, and regulatory compliance. At FinApt, we treat valuation not just as a technical exercise, but as a strategic tool that informs decision-making across transactions and reporting.

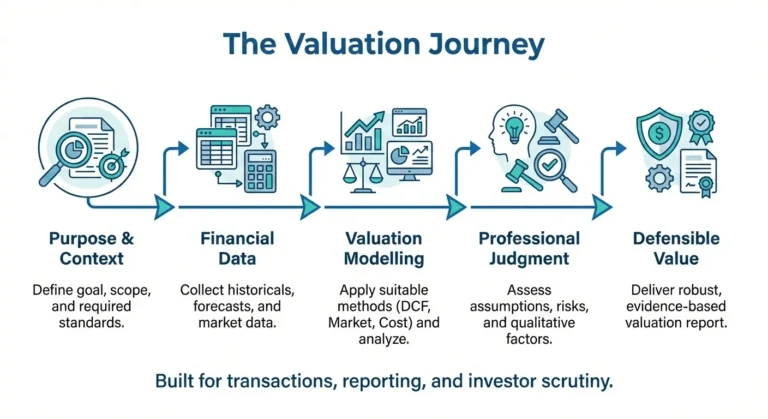

Whether supporting acquisitions, restructurings, financial reporting, litigation, or investor discussions, our valuations are insight-driven, defensible, and grounded in a thorough understanding of business fundamentals. Where transactions are involved, our valuation work is closely aligned with transaction due diligence, ensuring that value conclusions are supported by validated financial, operational, and commercial insights.

Valuation impacts deal pricing, tax outcomes, financial statements, and investor decisions. It supports:

Stakeholders increasingly demand transparency, independent analysis, and logical valuation frameworks to trust numbers and act decisively.

We tailor our valuation work to the specific objective, audience, and nature of the business. Our deliverables include:

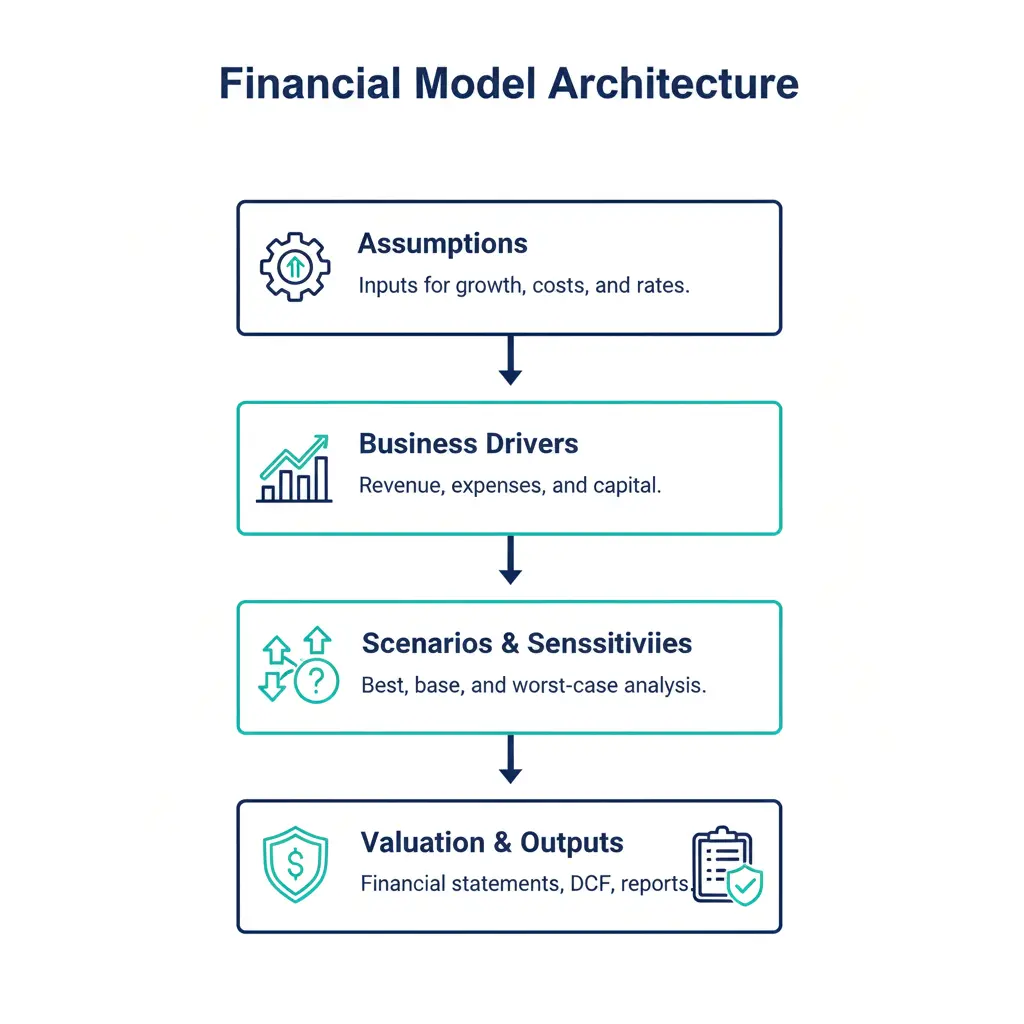

We build, review, and stress-test financial models that translate strategic objectives into measurable financial outcomes. Our models support valuation, capital allocation, and investment decisions, and are designed to be structured, transparent, and defensible under investor, audit, and board-level scrutiny.

Aligned with broader strategic and business planning, our financial modelling services ensure that assumptions, forecasts, and scenarios are grounded in realistic operating plans and market conditions.

Our financial modelling services include

Custom-built DCF, LBO, operational, or scenario-based models structured to support strategic decisions or transactions.

Validation of assumptions, formulas, linkages, and structure to ensure model logic is sound and investor-ready.

Ongoing maintenance and refinement of models for reporting, board presentations, or capital markets communication.

We deliver defensible, purpose-built valuations and models that stand up to investor scrutiny, audit requirements, and board-level decisions. Whether you're pricing a deal, planning for impairment, or defending value in negotiations, we provide valuation clarity where it matters most.

to ensure your valuation supports your strategy, not undermines it.

Answers to common questions on valuation and financial modelling, covering purpose, methodology, compliance, and practical application across transactions and reporting.

Business valuation is used for transactions, financial reporting, capital raising, shareholder matters, and regulatory or legal purposes. It helps stakeholders make informed decisions based on defensible financial analysis.

Purchase price allocation is required following a business acquisition under IFRS 3 to allocate the transaction consideration to identifiable tangible and intangible assets and liabilities.

Impairment testing assesses whether the carrying value of goodwill or intangible assets exceeds their recoverable amount, in accordance with IAS 36, using cash flow projections and appropriate discount rates.

The valuation method depends on the purpose of the valuation, the nature of the business, data availability, and stakeholder expectations. Approaches such as DCF, market multiples, and net asset value are often used together for validation.

Yes. Defensible valuations are supported by transparent assumptions, consistent methodologies, and comprehensive documentation, allowing them to withstand audit, regulatory, or litigation scrutiny.

Valuations and financial models should be updated whenever there are material changes in performance, market conditions, ownership structure, or reporting requirements. Investment valuations are commonly updated quarterly or semi-annually.

FinApt Chartered Accountants

FinApt Corporate Service Providers

FinApt Management Consultancies