Deals That Close. That Close. Value That Lasts.

Executing a successful transaction requires more than just identifying the opportunity — it demands thoughtful strategy, hands-on execution, and proactive risk management. FinApt’s Lead Advisory services help clients buy, sell, or restructure businesses with clarity and control. We work shoulder-to-shoulder with founders, shareholders, and corporates to deliver deals that are not only closed, but value-accretive.

Transaction execution is complex, emotional, and resource-intensive. Our Lead Advisory support ensures:

Whether you’re growing through acquisition, seeking an exit, or raising capital, we provide the roadmap and firepower to get there.

We offer full-spectrum M&A and capital markets execution support across:

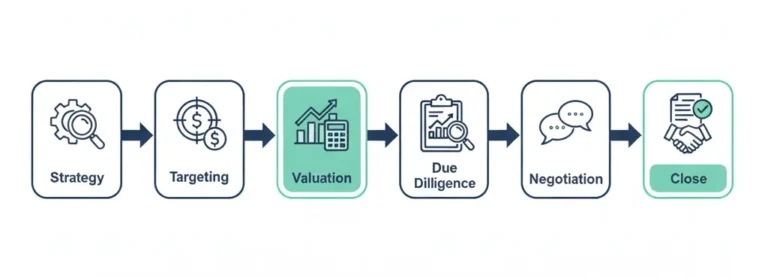

We support acquirers through target screening, valuation, due diligence coordination, deal structuring, and negotiation to enable strategic acquisitions.

We manage divestment processes from preparing the IM and identifying buyers to running competitive processes and negotiating deal terms.

We advise on the separation of business units, asset spin-offs, and transitional structuring to maximize standalone value.

We assist in IPO readiness assessments, listing strategy development, and coordination with legal and financial advisors.

We help leadership teams and investors structure, finance, and execute buy-outs, aligning incentives with long-term business continuity.

Each mandate is led by senior dealmakers who combine local execution depth with international investor access and sector insight.

Whether acquiring, divesting, or preparing for capital market entry, FinApt guides you through every phase of the deal lifecycle. We bring negotiation expertise, international investor access, and hands-on execution to help you close the right deal with confidence.

This section answers common questions about M&A advisory services in Dubai, including transaction scope, buy-side and sell-side support, valuation, due diligence, and deal execution. It helps business owners, investors, and corporates understand how professional M&A advisory supports confident, value-accretive transactions.

M&A advisory services in Dubai typically include buy-side and sell-side advisory, valuation support, transaction structuring, due diligence coordination, negotiation support, and execution through signing and closing. These services help businesses manage complex mergers, acquisitions, and divestments with clarity and control.

Strategic and business planning provides the foundation for successful M&A transactions by clarifying growth objectives, defining acquisition or exit rationale, and aligning deal strategy with long-term business goals. A well-developed strategic plan ensures that valuation assumptions, target selection, and transaction execution are grounded in realistic and executable business objectives.

A company should engage an M&A advisory firm in Dubai at an early stage—ideally before approaching buyers or targets. Early involvement ensures proper deal strategy, realistic valuation expectations, and smooth execution across valuation, due diligence, and negotiations.

Buy-side M&A advisory supports acquirers in identifying targets, assessing value, coordinating due diligence, and negotiating transactions. Sell-side M&A advisory focuses on preparing the business for sale, identifying buyers, managing competitive processes, and maximising value and deal certainty.

Valuation plays a central role in mergers and acquisitions by setting pricing expectations, influencing negotiation leverage, and shaping deal structure. Inaccurate or poorly supported valuations often lead to deal delays, renegotiations, or transaction failure.

Yes. As part of transaction advisory services, M&A advisors coordinate financial and commercial due diligence, manage advisors, identify risks early, and support negotiation and execution to minimize disruption and protect deal value.

Choosing a Dubai-based M&A advisory firm provides access to regional market insight, regulatory understanding, and relationships with regional and international investors. This local expertise is critical for executing transactions effectively in the Middle East.

FinApt Chartered Accountants

FinApt Corporate Service Providers

FinApt Management Consultancies